KEY POINTS

- Kansas City Fed President Esther George said she has concerns about a double-dip recession should the coronavirus see a resurgence.

- However, she said “it’s too soon to speculate” on whether the Fed might bring more policy help.

- She also expressed skepticism about allowing inflation to “run hot” as some central bank officials prefer.

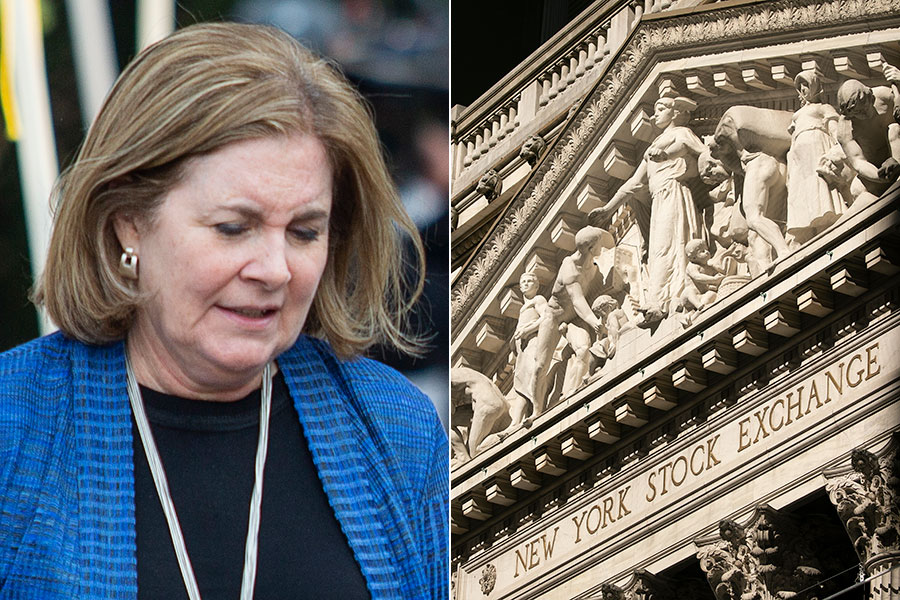

Kansas City Federal Reserve President Esther George said the economic downturn that started in February might revisit the economy if the coronavirus pandemic intensifies.

“A crucial threat to that outlook is thinking about what takes place as we enter into the fall, whether we see any renewal in the virus that would cause an extra pullback in the economy,” the central bank authorities said in an interview aired Wednesday. “We’ll keep track of that carefully to see whether that plays out.”

However, she said the standard is “we will continue to see the economy enhance,” and she did not dedicate to any further policy actions from the Fed, which already has cut short-term loaning rates to near no and instituted nearly a dozen loaning and liquidity programs.

“Financial conditions are accommodative. We have low rates, we still have the capability in those credit facilities,” George said. “So I believe it’s prematurely to try to speculate on whatever else might be required, other than to say the Federal Reserve is going to be extremely vigilant on that and be prepared to respond if they would have to.”

George spoke to Steve Liesman at a virtual version of the Fed’s annual symposium in Jackson Hole, Wyoming, which the Kansas City Fed hosts.

The conference comes at an essential time for the reserve bank, as it plots the path ahead after growth collapsed in the second quarter due to procedures targeted at including the infection.

Chairman Jerome Powell delivers the keynote address Thursday and is expected to detail a policy where the Fed will commit to keeping short-term rates of interest anchored near absolutely no until it achieves cost stability and gets the economy back to full employment.

Part of that might include allowing inflation to run hotter than the Fed’s 2% goal for a while, particularly if it continues to hold listed below the target. Core inflation, leaving out food and energy prices, is running at 1%, while the overall rate is 0.5%. George showed that everybody on the Fed might not be on board with the brand-new approach.

“I’m not a supporter of letting inflation run hot, because I’m uncertain what people mean by that,” she said. “I think we are bound to attain rate stability. That becomes part of our required.”